The Reality of Physician Home Loans: Redditors Share 8 Reasons It Was the Right Choice for Them

The quest for homeownership among physicians is a unique journey, often marked by financial complexities. Physician home loans or “doctor loans” have emerged as a unique opportunity for medical professionals to experience the benefits of home ownership early in their careers. While some physicians discussing on Reddit communities concluded physician home loans and home ownership were not right for them, for the great majority of those who did pursue a doctor loan and purchased a home, there were no regrets. Here we list 8 of the majors factors that contributed to their decision:

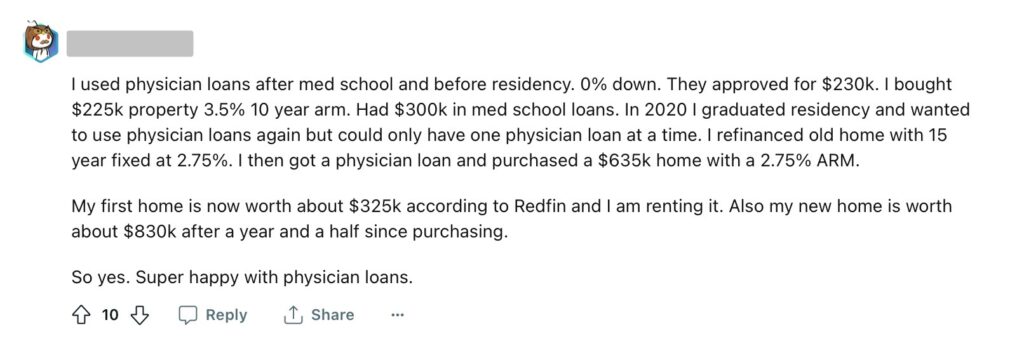

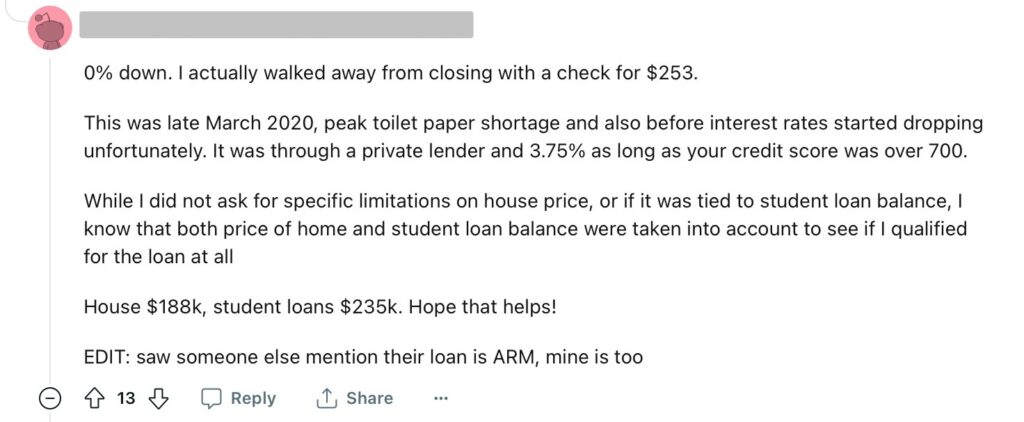

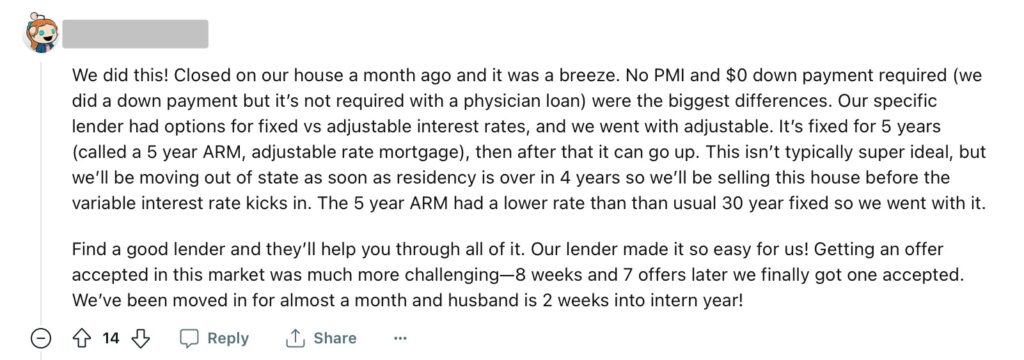

1. Low Down Payments

One Redditor commented : “I couldn’t believe how low the down payment was on my physician home loan! It made buying a home early in my career a tangible goal.”

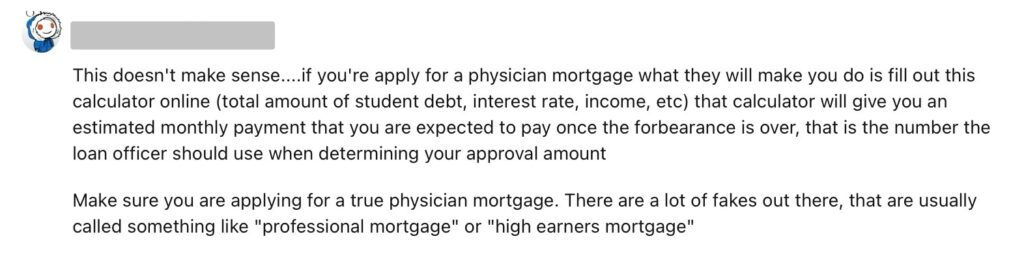

2. Student Loan Consideration

As one physician on the r/residency forum noted, “These loans took my student loans into account differently. It made a significant difference in the loan amount I qualified for, enabling me to secure a home faster than I expected.”

3. Flexible Debt-to-Income Ratios

Graduating medical school, most residency candidates will find themselves with a relatively high debt-to-income (DTI) ratio that makes qualifying for traditional home loans impossible. One Redditor commented, “During residency, my debt-to-income ratio was tight. Physician home loans offered the flexibility I needed to navigate this period without sacrificing my dream of homeownership.”

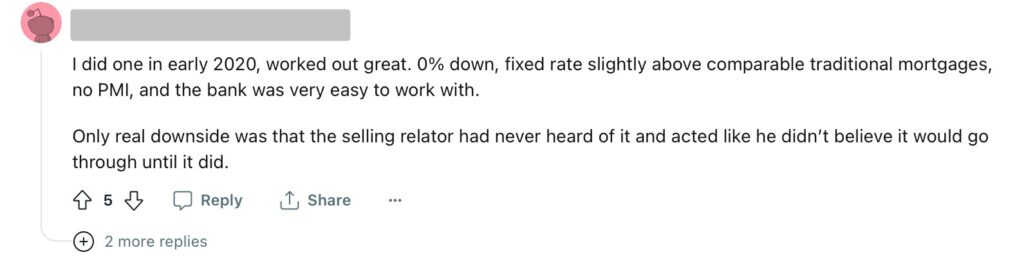

4. No Private Mortgage Insurance (PMI)

The cost of PMI added to a monthly mortgage payment for a medical professional in the early stages of their career can be difficult. And the total PMI paid over the life of the mortgage adds up to a substantial amount. As one Redditor noted, “Skipping PMI was a game-changer. It saved me a significant amount each month, making homeownership less financially burdensome.

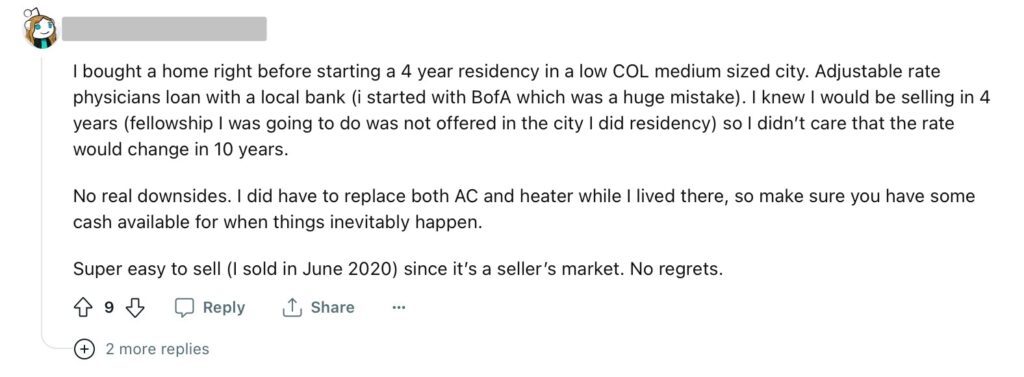

5. Tailored to Residency Periods

Physician Home Loans are structured to reflect the relatively modest income earned during the residency period. As one resident physician hoping to begin establishing their domestic life in addition to their professional life commented, “Finding a mortgage that understood my residency status was a relief. Physician home loans designed for this period provided the stability I needed during training.”

6. Competitive Interest Rates

Despite their flexibility, Physician Home Loans are not designed to trick or take advantage of the borrower. Doing the research, many qualifying medical professionals have found interest rates to be competitive while still providing the low down payment and 0% PMI of doctor loans. “I shopped around a lot, and the interest rates on physician home loans were competitive. It made the whole process more affordable for me.”

7. Quick Approval Process

Life moves quickly after being accepted into a residency program. Reputable physician home loans lenders are sensitive to this and will generally work with borrowers to provide expedited support that might not be available through traditional loan services. One resident physician on Reddit posted, “The quick approval process was a lifesaver. I didn’t have to wait for ages, which allowed me to seize the right opportunity when it came.”

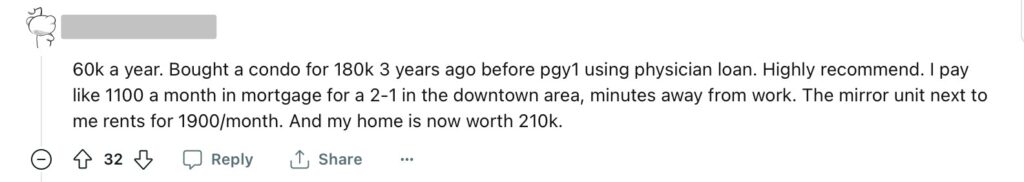

8. Lifestyle and Financial Benefits

Many resident physicians who pursued home ownership note their appreciation for the stability, control, and comfort owning a home has provided. In addition to a personalized living space, redditors have reflected on the financial returns they have the potential to recoup by building equity rather than paying rent without any return.

If you are considering a physician home loan and homeownership, you don’t have to do it alone. According to one Reddit commenter, having a knowledgeable guide by your side could help you avoid the “fakes”:

Curbside Real Estate can help you explore your options, whether it’s navigating home loans for doctors or making informed decisions about property investments. Schedule a Curbside Consult. If you’re pressed for time, our quick consult form is the perfect way to get the advice you need.

This blog post is for informational purposes only and is not intended as financial or real estate advice. Consult with a professional advisor before making any significant financial decisions.