October 8, 2025

As the government sits in a state of shutdown, many homeowners, future buyers, and physicians counting on student loan forgiveness have one big question: What does this mean for me? The truth is, the impact of a shutdown depends on its duration, how much government agencies are affected, and how lenders and servicers adjust. Here’s a breakdown of what to watch for and how to plan ahead.

As the government sits in a state of shutdown, many homeowners, future buyers, and physicians counting on student loan forgiveness have one big question: What does this mean for me? The truth is, the impact of a shutdown depends on its duration, how much government agencies are affected, and how lenders and servicers adjust. Here’s a breakdown of what to watch for and how to plan ahead.

1. Mortgage Loans: Delays, Uncertainty, and Rate Changes

a) Processing Delays for Government-Backed Loans

If a shutdown happens, agencies like HUD, FHA, VA, and USDA may have to furlough staff. This could cause a slowdown in the approval process for new or refinanced government-backed mortgages. Here’s what to expect:

- FHA Loans: Some new loans may stop being insured, and processing for existing applications could slow down.

- VA Loans: While home loan guarantees may still continue, staffing shortages could slow things down.

- USDA Loans: New direct and guaranteed home loans may be put on hold.

Even if you’re getting a conventional mortgage (one that’s not government-backed), delays can still affect your closing. For example:

- Income Verification: The IRS typically handles income verifications, but if staff are furloughed, this could delay things.

- Flood Insurance: If the National Flood Insurance Program (NFIP) is suspended, homes in flood-prone areas might not be able to close.

b) Interest Rates: Up or Down?

Shutdowns often create uncertainty, which makes investors seek safer options like Treasury bonds. This can push mortgage rates down. However, there are other forces that may drive rates higher, like:

- Economic Concerns: A reduced sense of economic stability could cause rates to rise.

- Lack of Data: Missing economic reports (e.g., job data) might make the markets more volatile.

- Lenders Protecting Themselves: If lenders face uncertainty, they may raise rates to cover risks.

So far, mortgage rates have stayed relatively steady, but if the shutdown drags on, you could see slight fluctuations which you can track on the Consumer Financial Protection Bureau Mortgage Tracking Tool.

- Tax Refund Delays: If the IRS is impacted, you may experience delays in tax refunds, which could affect your ability to make payments.

- Backlog of Applications: Once the shutdown ends, lenders might have a backlog of work to catch up on.

- Lower Consumer Confidence: If buyers hesitate, housing demand could drop, which might slow down sales and affect pricing.

Bottom Line: If you’re in the middle of a home purchase or refinancing, stay in regular contact with your lender and be prepared for possible delays.

2. Physician Home Loans & Specialty Mortgages

Physicians often turn to specialized mortgage programs that offer perks like lower down payments and more flexible credit requirements. But how could a shutdown affect these?

a) Delays in Underwriting

Even physician loans are tied to standard underwriting processes, meaning any delays that affect traditional mortgages (like IRS verifications) could slow down your approval as well.

b) Risk of Program Suspension

Some physician loan programs rely on government support or agencies that depend on annual funding. During a shutdown, these programs may be delayed or paused. For example:

- If your loan relies on HUD or a similar entity, it could be impacted by staffing shortages or funding cuts.

- Changes in secondary market conditions (e.g., reduced guarantees) could also disrupt your mortgage.

c) What Physicians Should Do

If you’re a doctor in the middle of buying a home, consider these steps:

- Ask About Vulnerability: Check with your lender if the program is affected by government shutdowns.

- Get Your Docs in Order: Submit all documentation early to minimize delays.

- Know Your Alternatives: Have a backup plan in case specialty loan programs face delays.

- Be Flexible with Rate Locks: Avoid locking in rates too early if the program’s availability is uncertain.

In Short: Physician loans aren’t immune to the same issues affecting other mortgage programs. Plan ahead to avoid surprises.

3. Public Service Loan Forgiveness (PSLF) & Student Loan Processing

Many physicians working in public service rely on Public Service Loan Forgiveness (PSLF) to manage their student debt. A shutdown could delay some aspects of this process.

a) Potential Slowdowns in Servicing

Even though private contractors handle student loan servicing, the Department of Education (DOE) and Federal Student Aid (FSA) still play an important role in overseeing PSLF. In the event of a shutdown:

- Consolidation Requests: These may be delayed if FSA staff are furloughed.

- PSLF “Buyback” Program: The process of recalculating prior payments may slow down.

- Forgiveness Decisions: There could be a backlog of PSLF approvals and audits.

However, loan payments will still need to be made, and servicers will continue operating as usual.

b) Ongoing Legislative Changes

Even without a shutdown, PSLF is already facing potential changes. Some recent proposals suggest:

- Residency Exclusions: PSLF eligibility might exclude time worked during medical residency starting in 2026.

- Changes to Income-Driven Repayment (IDR) Plans: New plans could replace the current IDR structures.

- Eliminating Benefits Under SAVE Plans: Interest subsidies for some plans (like the SAVE plan) may disappear by 2025.

These proposed changes could have a bigger long-term impact than a short shutdown, adding uncertainty to the program’s future.

c) What Physicians Should Do

If you’re relying on PSLF, take these steps:

- Submit Your Employment Certification Now: Don’t wait—submit your certification through your employer and the PSLF portal.

- Stay Informed: Keep an eye on legislative proposals that might impact your eligibility.

- Have Backup Strategies: Keep making payments and track your progress. Consider building a “PSLF fund” to cover any unexpected changes.

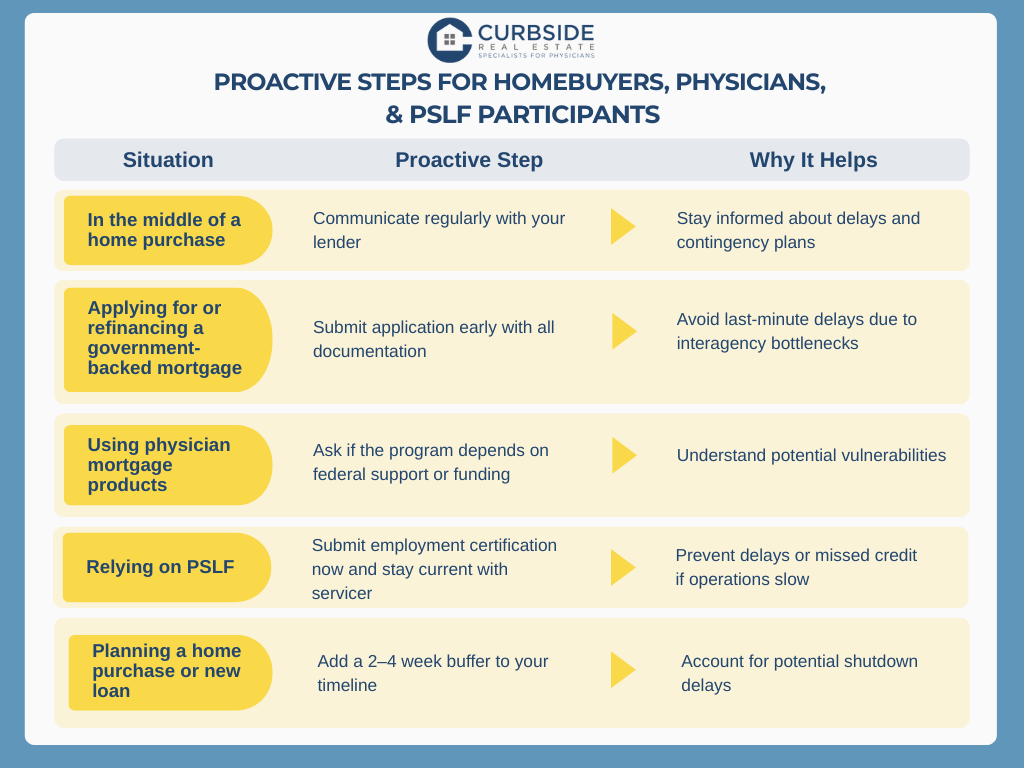

4. Proactive Steps for Homebuyers, Physicians, and PSLF Participants

5. In Summary

A government shutdown may not immediately disrupt mortgage markets or PSLF programs, but it will likely cause delays and added uncertainty—especially for those relying on government-backed financing or student loan forgiveness. Whether you’re buying a home, refinancing, or pursuing PSLF, it’s important to:

- Stay in close contact with your lender or servicer

- Submit all required documents early

- Have backup plans in place

By taking these steps, you’ll be better prepared for whatever a shutdown might bring. And Curbside Real Estate is here for you if you as you navigate your road to home ownership. We’re happy to point you towards useful resources and provide you the assistance you need to achieve your homeownership goals–and as always, at no cost to you.

This blog post is for informational purposes only and is not intended as financial or real estate advice. Consult with a professional advisor before making any significant financial decisions.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]