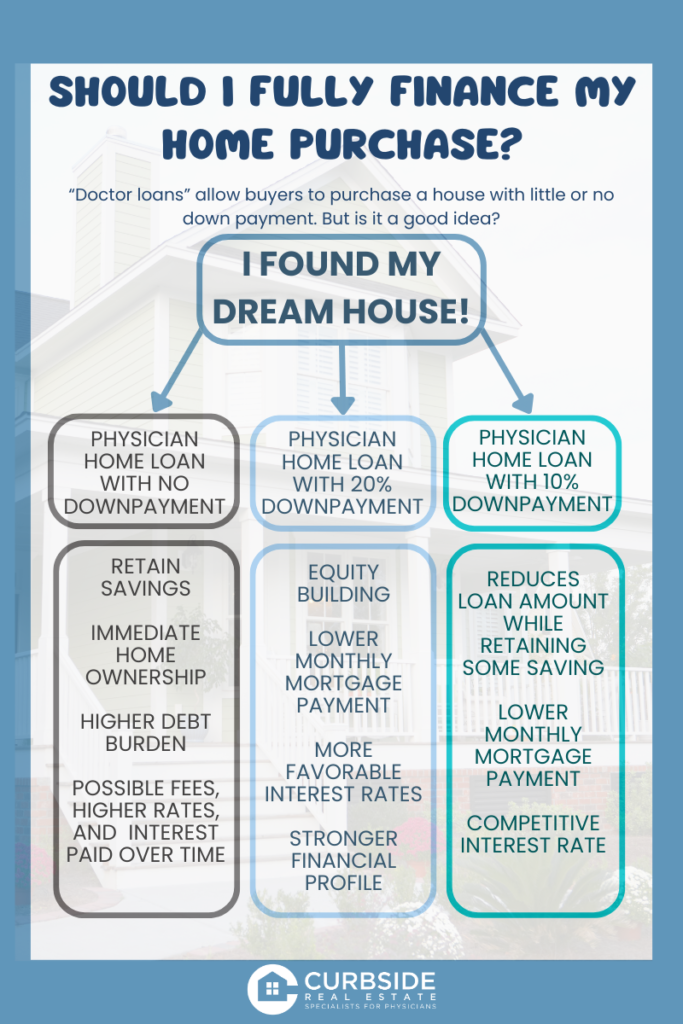

When considering a home purchase, financing the entire amount including closing costs, can be an enticing option for many home buyers. Alongside traditional mortgage options offered to well-qualified buyers, physician home loans offer medical professionals the opportunity to become early homeowners with very little out of pocket costs. But you may be wondering, is there a catch? Here we’ll cover some of the major benefits and risks of fully financing your home purchase.

When considering a home purchase, financing the entire amount including closing costs, can be an enticing option for many home buyers. Alongside traditional mortgage options offered to well-qualified buyers, physician home loans offer medical professionals the opportunity to become early homeowners with very little out of pocket costs. But you may be wondering, is there a catch? Here we’ll cover some of the major benefits and risks of fully financing your home purchase.

Benefits

- Minimal Upfront Costs:

Financing the entire home purchase, including closing costs, minimizes the need for a large upfront cash outlay. This can be especially beneficial for physicians who may have substantial student loan debt or are early in their careers. - Preservation of Savings:

Physician home loans often require minimal or no down payment, allowing buyers to preserve their savings for other financial goals such as retirement savings, investing, or paying down debt. - Flexible Qualification Criteria:

Physician home loans typically have more lenient qualification requirements compared to conventional mortgages. Lenders may consider factors such as future earning potential and employment contracts rather than just current income and debt levels. - No Private Mortgage Insurance (PMI):

Many physician home loans waive the requirement for private mortgage insurance, even with a low down payment. This can result in significant savings over the life of the loan compared to traditional mortgages. - Tailored Loan Products:

Physician home loan programs often offer specialized loan products designed specifically for medical professionals, such as jumbo loans, adjustable-rate mortgages (ARMs), or interest-only options. These products can provide flexibility and customization to meet individual financial needs.

Risks

- Higher Interest Rates and Debt Burden:

Physician home loans may come with slightly higher interest rates compared to conventional mortgages especially when financing the entire cost of the home. This can result in higher monthly payments over the life of the loan and a larger debt burden, which can strain finances, particularly during the early stages of a medical career when income may be lower. It’s crucial to consider whether the monthly mortgage payments are sustainable alongside other financial obligations. - Limited Availability:

Physician home loans are typically offered by select lenders and may not be available in all geographic areas. As a result, physicians may have fewer options when it comes to choosing a lender or loan product. - Potential for Negative Equity:

Financing the entire home purchase, especially with a minimal or no down payment, increases the risk of negative equity if property values decline. This can pose challenges if you need to sell the home or refinance in the future. If you experience financial difficulties and are unable to make mortgage payments, the lack of equity in the home increases the risk of foreclosure. - Restrictions on Property Types:

Some physician home loan programs may have restrictions on the types of properties that qualify for financing, such as condominiums, multi-unit properties, or investment properties. It’s essential to understand these limitations before selecting a loan product. - Limited Refinancing Options:

Physician home loans may have fewer refinancing options compared to traditional mortgages. Borrowers should consider the long-term implications of their loan choice and evaluate potential refinancing needs down the road.

Before committing to financing the full cost of a home with a physician home loan, it’s crucial for medical professionals to assess their financial situation, career trajectory, and long-term goals. Consider consulting with an advisor such as Curbside Real Estate to evaluate the affordability of homeownership, explore alternative financing options, and develop a comprehensive home purchasing plan. While physician home loans offer an enticing opportunity for doctors to achieve homeownership sooner rather than later, it’s essential to weigh the risks and benefits carefully. By making an informed decision with trusted partners and planning strategically, medical professionals can embark on their homeownership journey with confidence and financial security.

This blog post is for informational purposes only and is not intended as financial or real estate advice. Consult with a professional advisor before making any significant financial decisions.