August 21, 2025

What Medical Residents Need to Know About PSLF Under the Trump Administration—and How It Could Affect Homeownership

For years, many medical residents and early-career physicians have looked to Public Service Loan Forgiveness (PSLF) as a light at the end of the tunnel. The promise of loan forgiveness after 10 years of qualifying payments has been a critical factor in financial planning—especially for those in training programs at nonprofit hospitals.

But under the Trump administration in 2025, PSLF is facing major uncertainty. If you’re a medical resident today, it’s important to understand how these changes may affect your career path, your financial stability, and ultimately, your ability to achieve milestones like buying a home.

The Current State of PSLF

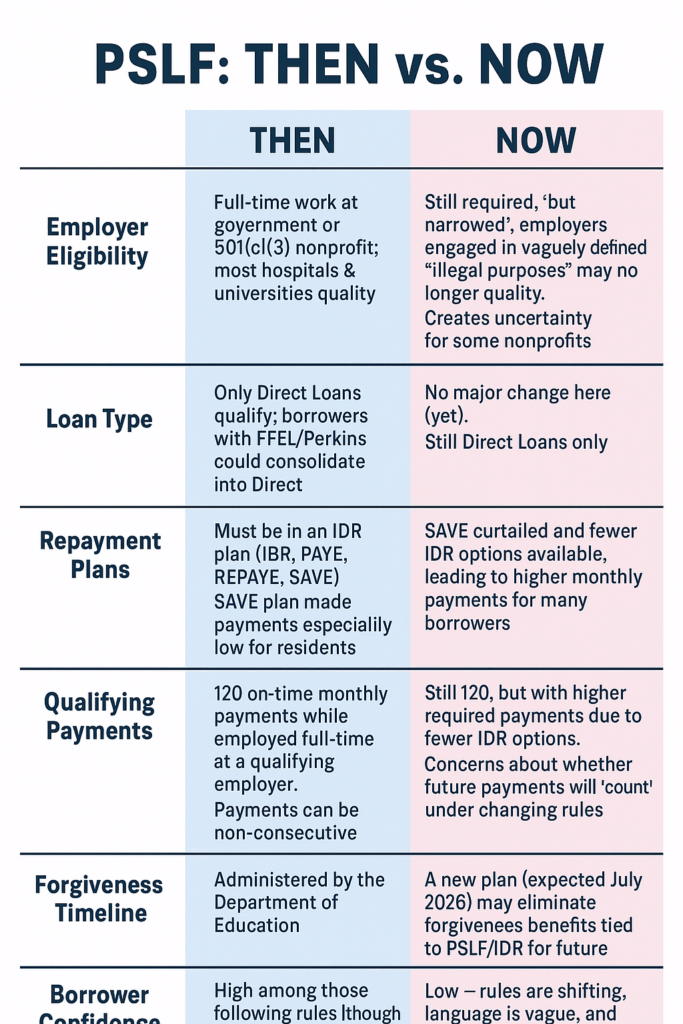

Recent actions by the Trump administration have reshaped the PSLF landscape:

- Employer Eligibility Narrowed: A March 2025 executive order introduced vague restrictions that could exclude certain employers from qualifying for PSLF. While most hospitals remain eligible, the broad language has sparked concern about what “illegal purposes” might mean for nonprofit healthcare systems.

- Fewer Income-Driven Repayment (IDR) Options: The administration has curtailed access to popular repayment plans like SAVE, raising monthly obligations for many borrowers.

- Restructuring of Oversight: Efforts to dismantle the Department of Education and shift student loan servicing elsewhere create uncertainty about the future administration of PSLF.

In short: PSLF still exists, but its long-term future and borrower protections feel far less certain than in prior years.

Why This Matters for Residents

Residency is already a financially tight chapter—long hours, modest salaries, and large student loan balances. For many, PSLF has been part of the strategy: stick with nonprofit hospitals, make income-driven payments, and look forward to forgiveness as an attending.

Now, with PSLF under political pressure, residents need to weigh:

- Career Flexibility: Will you choose a nonprofit employer just for PSLF, even if private practice could offer higher pay and lifestyle balance?

- Higher Loan Payments: If repayment plans tighten, your monthly cash flow during residency may shrink, making it harder to save for a down payment.

- Delayed Forgiveness: If PSLF is altered or dismantled, you may end up carrying loan balances longer, impacting your debt-to-income ratio (DTI)—a key metric lenders use for mortgage approval.

The Link Between PSLF and Homeownership

Physicians often delay buying a home until after residency or fellowship, partly because of student debt. Here’s how the changing PSLF landscape could impact your path to homeownership:

1. Debt-to-Income Ratios Could Rise

Without PSLF or with fewer repayment options, loan balances may weigh heavier in your mortgage application. Lenders calculate DTI ratios based on your monthly student loan payments, so higher payments mean tighter mortgage qualifications.

2. Down Payment Savings May Shrink

If you’re forced into higher monthly payments during residency, less cash will be available to set aside for a future down payment.

3. Uncertainty Around Forgiveness

Even if you’re making qualifying payments now, shifting rules may mean forgiveness isn’t guaranteed in 10 years. This uncertainty could affect how comfortable you feel committing to a mortgage in the near future.

4. Specialized Physician Loans Still Exist

Fortunately, physician home loans—designed specifically for doctors—remain an option. These loans often allow for little or no down payment, ignore student loans in DTI calculations, and waive private mortgage insurance (PMI). For residents, this can be a lifeline even if PSLF changes limit forgiveness opportunities.

What Residents Can Do Now

If you’re a medical resident, here are practical steps to safeguard your financial future:

- Stay Informed and Submit Your Comments:

Policy changes are ongoing. Track updates from the Department of Education and professional organizations like the AMA. You can also submit your comments to the Federal Education Department and legislators by September 17, 2025 on how the proposed changes may impact you. - Explore All Repayment Plans:

Don’t assume PSLF will carry you through—compare the numbers for standard repayment, refinancing, and physician-focused loan programs. - Work with a Financial Advisor:

Specialists who understand physician finances can help you adapt to changes while planning for milestones like homeownership. - Learn About Physician Home Loans Early:

Even if homeownership feels far away, understanding physician loan options now can prepare you for a smoother transition when you’re ready.

The Bottom Line

For medical residents, PSLF has always been a beacon of hope in managing overwhelming student debt. Under the Trump administration, however, that beacon is flickering. While PSLF still exists, its future is uncertain, and residents should prepare for scenarios where forgiveness plays a smaller role in their financial plan.

The good news? Homeownership is still within reach. With physician mortgage programs and careful planning, you can build a path toward buying a home—even if the policy landscape shifts beneath your feet.

At Curbside Real Estate, we specialize in helping physicians navigate the unique challenges of student debt and homebuying. If you’re a resident wondering how today’s PSLF changes could impact your future, we’re here to guide you every step of the way.

Disclaimer: The information provided in this article is for general informational purposes only. It should not be construed as financial, legal, or medical advice. Always consult with a qualified professional before making any significant decisions.